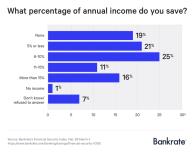

A significant portion of Americans are saving nothing for retirement and very little in their day to day lives. While the unemployment rate is low and wages are seeing an increase the American worker is not saving enough of their income which will inevitably lead to shortfalls of operational cash during an unexpected crisis and in their retirement years further down the road.

Bankrate maintains that half of all Americans will not be able to maintain their standard of living once they have stopped working. GoBankingRates corroborates these findings citing that over forty percent of Americans have less than $10,000 dollars saved for their retirement. These statistics point to a dismal retirement future for nearly half of all Americans.

This doesn’t have to be your future. It doesn’t matter how little you currently save. You don’t have to become the horror story of retiring and meeting financial ruin like so many do. What matters is that you change the trajectory of your retirement life by proactively examining how you are spending and saving. The sooner you begin the better your chances of success.

The first and most important strategy to implement is learning to live beneath your means. That translates into saving money: probably more than you currently do. Saving money is an underestimated survival skill. To save begin by tracking your spending habits for thirty days.

Once you have the data create a realistic and doable budget. Fluid expenditures like groceries, eating out, clothing, gasoline, and auto maintenance need to have a set monthly budget. Create a simple two columned sheet of paper with budgeted and actual expenditures to monitor your progress. Typical categories where you can reduce expenditures include; cable packages, phone plans, groceries, entertainment costs, gym memberships, clothing and dining out. Start asking yourself over and over “Is this a need or a want?” and if it is a need, how can you make the cost lower. The game is how much money you can save, not spend.

Consolidate your non-essential debt and pay it off, completely. Make it a primary goal to get out of debt. Stop being a debt slave. In the credit card industry, there is an insider term used for people who fully pay their credit cards off each month. Guess what it is? It is a deadbeat. Companies cannot make money off of you if you stop becoming a slave to debt. If you can’t afford it then find a way to live without it.

Double-check your insurance rates on your car, homeowner, and health. Do not purchase flight insurance, extended warranties, and disease insurance. Check this site for fifteen insurance policies you don’t need. Get rid of the policy altogether or find wiggle room for reduced premiums or get a more competitive provider to save money.

Get rid of automatic payments attached to your banking accounts. Most people can eliminate expenditures they forgot they are even locked into. This also forces you to take control of your bill/payment cycles. Being involved in the day to day of bill payment keeps you far more aware of your financial situation and keeps your mind active.

Consider downsizing your home. If you are in a two-story house it is inevitable that one day you will not be able to climb those stairs. A one-story home or a first-floor condo or apartment can help you purge your life of ‘stuff’ you no longer need. Some of those things can be sold and the proceeds can be saved. Any profit left over from downsizing immediately goes into savings or a financial investment vehicle to provide and protect your senior years.

These are some but not all of the ways it is possible to change your savings habits. Guidance from a trusted professional is key to the pathway of success because there will always be roadblocks and setbacks that you must make adjustments for. Structuring a legal plan in connection with a retirement plan can provide added protection and allow you to enjoy retirement more thoroughly.

Contact the Alabama Center for Elder Law today and schedule an appointment to discuss how we can help you with your planning. You can reach us by sending us a message online or by calling us at (334) 792-6213.